Juniper Publishers-The Crisis of our Time and the End of the New “History”

Juniper Publishers- Open Access Journal of Social Sciences & Management studies

Introduction

The time has come to understand that we are facing an

anthropological and not economic crisis as it is reductively defined;

it is the failure of a socio-cultural model that has erased the

fundamental human rights inscribed in 1948. The response to the crisis

[1] as anthropological is in understanding the cultural and historical

path that has brought us to chaos, overthrowing the dominant paradigm,

to place man and society at the centre of our interests as an end and to

bring economics back to its natural role as a means. The technical

culture, master of the world, as defined by Emanuele Severino, has

unnaturally transformed economics as a social science into an exact

science; in the exact sciences we study the relationships between

measurable things to define universal laws, but in the social sciences,

such as economics, we study relationships between men where human

subjectivity does not allow defining universal laws [2-4].

Von Hayek in his Nobel acceptance speech in 1974

denounced the serious mistake that would pave the way for rational

finance and speculative markets distant from the real world; but he

remained unheard. The extreme financialization of the real economy

became deeply rooted since 1971 when Nixon unilaterally declared the end

of the dollar’s convertibility into gold. Let us look at the sequence

of events. In 1945, after the drama of war, rules were defined to

stabilize markets and exchange rates; the printing of paper money that

has no value was tied to a defined quantity of a real good and the “gold

exchange standard” was launched - 36 $ for every ounce of gold. In that

period that lasted until the beginning of the 70s, we had a fixed

exchange rate system that favoured unprecedented economic and social

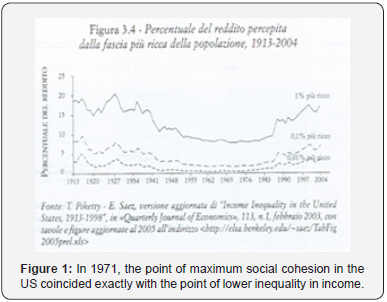

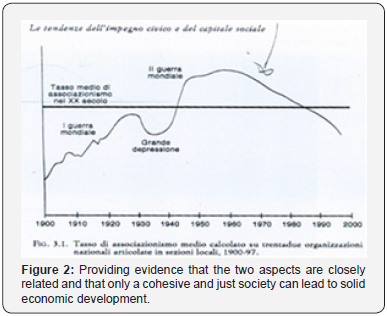

growth [5-7]. In 1971, the point of maximum social cohesion in the US

coincided exactly with the point of lower inequality in income,

providing evidence that the two aspects are closely related and that

only a cohesive and just society can lead to solid economic development

[8] (Figures 1 & 2).

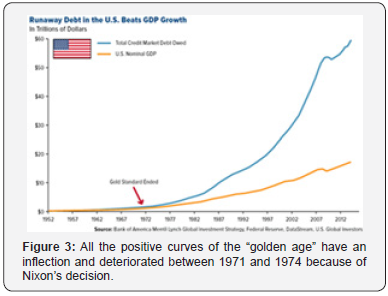

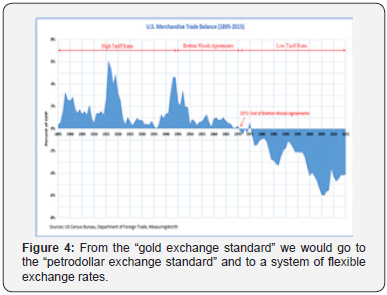

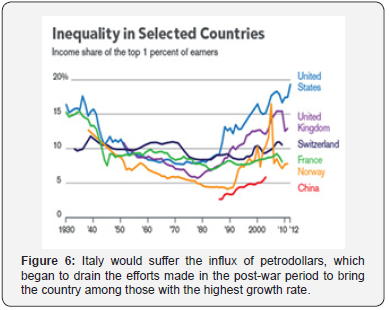

All the positive curves of the “golden age” have an inflection

and deteriorated between 1971 and 1974 as a result of Nixon’s

decision; from the “gold exchange standard” we would go to

the “petrodollar exchange standard” and to a system of flexible

exchange rates, and we would suffer terrible inflation that

went from 4.4% to 24%, paving the way for today’s drama of

uncontrolled finance, as we see in following graphs (Figures 3-6).

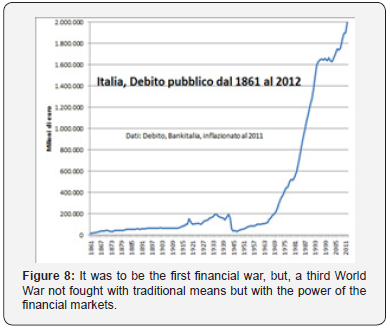

Italy would suffer the influx of petrodollars, which

began to

drain the efforts made in the post-war period to bring the country

among those with the highest growth rate; the price of oil per

barrel went from $ 1.40 to $ 40, and the dollar/lira exchange rate after

25 years of the fixed exchange rate of 624/5 lira for every

dollar to 2450 lira for a dollar in just 9 years: it was to be the first

financial war, but in reality a third World War not fought with

traditional means but with the power of the financial markets [9-

11] (Figures 7 & 8).

The separation of paper money from the real finite created

two incompatible systems: the infinite and non-measurable of

currency that would be totally deregulated, and the finite and

measurable of the real world that became fictitiously subordinate

to the former [12,13]. Everything changes, and the neoliberal

model taken as an end justifies unlimited personal accumulation

and the legitimisation of human aggression. Everything becomes

finance and pure speculation in virtue of a paper currency that,

detached from finite bonds and the real world, becomes infinite

and would turn into “macro-usury” capable of keeping companies

and entire countries in check [14,15]. Infinite finance without

constraints can be studied with exact mathematical models

generating the false idea that financial markets are rational

and never err in the allocation of wealth. The study of financeeconomics

severs the ties with the humanistic sciences, becoming

a pure arithmetic calculation far from reality but assumed as

incontrovertible truth thanks to the many Nobel prizes assigned

to economics, unfounded but serving higher interests [16-18].

The Role of the Humanistic Culture that the Academy has Lost

Since the late 60s, in awarding the prizes for literature,

economics, and peace - the three prizes with the most obvious

contradictions - the anomalies have become more apparent,

favouring a cultural model and its interests that have brought us

to the true crisis of our time, the anthropological crisis that we

still refuse to see. Since 1969, when the first prize for economics

was awarded, American scholars have won the lion’s share [19-

21]. In the 44 years of Nobel prizes in economics, one or more than

one has been awarded the prize 41 times: a monoculture without

inconsistency and change 41 times out of 44. Only in three years

did they not win: 1969, 1974, and 1988.

The trend was accentuated after the fall of the Berlin Wall

when the awards rained down on economics scholars who defined

the financial markets as rational and exact without possibility of

error [22]. Finance has become a sort of hegemonic weapon over

States able to exert pressure on the policies of individual States

and global choices. Wealth is thus created without States and

States without wealth, a model of an individualistic and conflictual

society in which moral sense is subservient to personal interests

and the strongest command. Yet, is the soul of this cultural model

able to inspire feelings such as kindness, altruism, solidarity,

respect for humankind, in short, the ideals that Alfred Nobel

sought?

The answer can be found with disarming evidence in the

prizes awarded for literature. In fact, since the end of the 60s, the

United States that seemed omnipotent has only won one real prize

in literature. Morrison, in 94, expressed the racial pain of coloured

minorities, now majorities; Bellow in 76 and Singer in 78, were

the expression of the European culture where they had lived

for a long time before moving to the United States [23-25]. The

other awards over the years have been divided among different

countries where the type of wellbeing expressed by the economy

was absent or irrelevant - for example, Ireland, Peru, Chile, Saint

Lucia, Poland, Romania, Greece... The two cultural models are

opposed, without the possibility of dialogue and sharing because

the interests of economics and finance put the maximization of

self-interest in first place and not the “common good”, exactly

what Alfred Nobel wanted to avoid. The legitimacy of the single

thought has suffocated the imagination and the universal values

of freedom, equality and solidarity. In the words of Pascal, “l’esprit

de finesse” was finally separated from the “esprit de geometrie”,

but rational man arrived last in the race. Everyone is responsible,

albeit in different ways, because everyone contributed, even in

silence, to ascribing the value of incontrovertible truth to these

positions [26].

The technical-rational culture of the post-modern era

prepared by the field of speculation since the Enlightenment with

Kant, Hegel, and then Marx transformed economics into an exact

science by studying only what is measurable. The materialistic

objectives promoted by capitalism and liberalism assumed as

an end and not a means contributed to the creation of a society

aimed at achieving self-interest at the expense of the common

good and the normalization of unlawful behavior [27]. This has

increasingly forced dominant interests to legitimize such studies

with the Nobel Prizes that elevated their achievement to ultimate

truth but not the real sciences, eventually disrupting the system of

social relations, because the dogma has become ‘live to earn’ and

not vice versa. This year once again, in rewarding the disrupting

sociocultural model of human society, the Academy has deeply

betrayed the noble intentions of Alfred Nobel.

Understanding the deviations of economic studies transformed

from a social and moral science into a merely quantitative, exact,

and positive science requires understanding the causes that favour

the interests of the few at the expense of everyone else. At the end

of World War II, the global dramas led to defining the universal

and “inalienable” rights of man and the technical operational rules

of economics in such a way as to guide global policymakers to

restore the dignity of man as a person and not as he is in fact today.

Literature Review

Everything becomes finance and everything is justified as

“strictly scientific” by the Nobel Prize in Economic Sciences; the

pursuit of maximum personal gains justifies the normalization

of illicit behaviours, everything is played in a short or very short

term logic in an infinite exchange at high speed where computers

decide according to algorithms based on the nothingness of

infinite finance, without anything underlying it. Stock exchanges

become infinite casinos without rules or maximum profit in

an amoral logic because those deciding in finance never pose

themselves the problem of the consequences of their actions,

and since it is always man who engages in illicit behaviours they

become a practice of life that extends to young people who lose

their identity in the confusion of value, becoming plankton at

the mercy of the waves. Society without values and a humanistic

culture become territories in which it is difficult to live and the

individualism pursued as an end eradicates the first impulse that

dictates the human spirit, that of aggression and lack of attention

to others; “societas” understood as an alliance is transformed into

the monster of the “bellum contra omnes”, the war of all against all,

and everything becomes lawful [28].

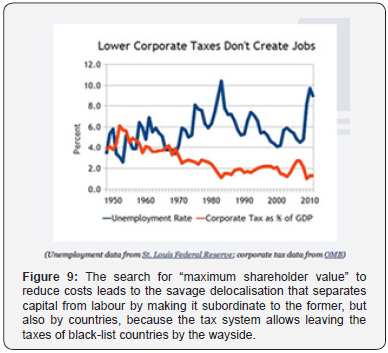

The search for “maximum shareholder value” to reduce

costs leads to the savage delocalisation that separates capital

from labour by making it subordinate to the former, but also by

countries, because the tax system allows leaving the taxes of blacklist

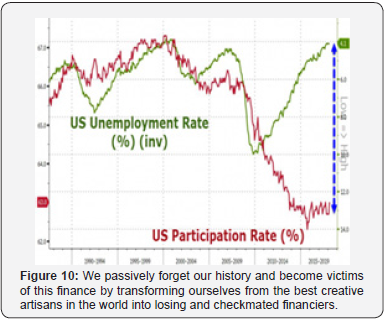

countries by the wayside (Figures 9 & 10). We passively forget

our history and become victims of this finance by transforming

ourselves from the best creative artisans in the world into losing

and checkmated financiers; the social system disintegrates and

fragments, social ills explode, and the old solidarity of our people

becomes a war of all against all with growing moral degradation

because it justifies living to earn and not vice versa. Locust

finance must be brought under strict control, eliminating the

speculative derivatives that have emptied the reserves, redefining

the boundary between business and commercial banks, but

also with a return to the convertibility of currency into gold, as

China, Russia, and other emerging countries close to creating an

alternative financial system to the dollar are doing, because the

new balances of power allow it [29].

The challenge of our time is to rebuild a cohesive social

system, recovering the solidarity of our familial roots and the

small and medium-sized businesses that constitute the backbone

of our nation over time, and recover the pride of our history and

autonomy that allows us to decide without having a gun pointed

at our heads. History, forgotten by a society that lives only in

the present, teaches over the millennia that a society can live

only on solid family roots and maintain a trade-off between the agricultural world that generates solidarity and the urban world

that creates individualism. Will we be able to understand the

lessons of history? This is the enigma we have before us [30-31]

(Figure 11).

For More Articles in Annals of Social Sciences & Management studies

Please Click on: https://juniperpublishers.com/asm/index.php

For More Open Access Journals In Juniper Publishers Please Click on: https://juniperpublishers.com/index.php

Comments

Post a Comment