The Digitization of the Economy and the New Dynamics of Industrial Firms-Juniper Publishers

Juniper Publishers-Social Anthropology

Abstract

The digital revolution imposes new modes of

consumption and production. Internet, networks, big data, information

flows, connected objects, applied services: the whole ecosystem is

modified. Beyond the major socio-economic issues, there are upheavals in

geopolitical equilibrium and the emergence of a new economic order,

despite low levels of growth. Leading firms, such as GAFAM, are adopting

monopolistics strategies that threaten the major market equilibria and

force us to question the regulatory instruments.

Keywords: Digitization; Innovation; Organization; Model; Industry; Firms; Performance; Growth; Globalization; Local Development

Introduction

Before the massive spread of Internet in the 1990s,

the media markets were compartmentalized. The integration of large

groups was mainly vertical, thanks to deregulation initiated in the

field of television (ABC, Disney, AOL-Time Warner). This structuring has

been completely modified with the arrival of digital technologies.

Historical groups in this field are gradually entering into competition

with others from related fields such as networks, operating systems,

computer equipments, Internet platforms, etc. This is the phenomenon of

verticalization of the value chain » often emphasized by Lombard [1,2].

New digital giants are born: the GAFA or GAFAM Google, Apple, Facebook,

Amazon and Microsoft.

Henceforth, the goal is to make a coherent ecosystem

mastering at the same time, upstream the constraints related to the

setting up of the networks and supports carrying the information

(containers) and, downstream the expectations of the final users in

terms of both basic services and more sophisticated digital solutions

(contents). The market structure is oligopolistic. Therefore,

competition occurs in an environment where both competitors and partners

coexist. Indeed, the actors are in coopetition as indicated by Rosele

Chim [3-8] examining the classical theories on competition and those on

cooperation. Thus, they compete on certain markets or segments and

cooperate on others, each one seeking to satisfy a targeted demand

according to his level of specialization or his core business.

The digital revolution is in processing and imposes

new modes of consumption and new business relationships. Several

questions

then arise. What are the effects of training on organizational models,

distribution methods, the distribution of employment, which finally

question labor law and social protection? To what extent can businesses

reinvent themselves to adapt to these significant changes? How can

individuals and society be able to cope with the rise of the vast

process of disintermediation that is taking place on the targeted

markets (the phenomenon of uberization of the economy)? All these

questions are essential as this process is altering our vision of the

world and is modifying our practices.

Our Study Presents Three Highlights that Focus on These Issues

a. firstly, the digitization as a factor of a new industrial economic order;

b. secondly, the new power of firms thanks to the multiplier networks of the current revolution;

c. finally, the risks of imbalance of the system and possible regulation instruments.

The Digitization for a New Economic Order

New Information and Communication Technologies

(NICTs) have often given the feeling of the appearance of « New Economy »

compared to « Old Economy ». The configurations outlined by the

technological alliances of firms propelled the industrialized countries

into the emergence of a long cycle of growth with strong disruptions.

Economic renewal puts traditional analysis to the test. Perceptions are

varied between electronic economy, digital

economy and industry 4.0. The field covered by digital economy

is very distinctive.

Approach and Framework of Analysis

Let us choose the following approach: all economic and social

activities using internet networks, connected objects, electronic

sensors that mobilize aggregation of « big data » for the treatment

of information of their entire value chain from the producer to

the final customer. Today modern firms must first create desires

in the consumer’s life in order to be able to impose themselves

as a producer guaranteeing their satisfaction. In Galbraith [9]

revised sequence », in contrast to classical industry where offer

for goods and services must satisfy demand of consumers, it is

the individual with unlimited needs who serves the expansion of

economic structures.

Would demand dictate its law to offer? Maybe indirectly,

unbeknownst to consumers. Apple, like other digital giants, did it

not captivate its customers to sell them the created applications

and services? Indeed, the dynamics of the entire ecosystem is

based on the « manufacture » of a being in the grip of the need

to consume. The latter is the means likely to ensure the growth

for growth that presides over the decisions of the technostructure.

As technology and power of computation are no longer limiting

factors, firms seek to collect considerable data, which are then

aggregated, processed, stored. This information is useful for

controlling the production process (producers) and better market

expectations (customers).

The changes brought about by digital technology compel

world-class firms, as well as smaller firms, to permanent

adaptations, both technologically and organizationally because

of the change in uses, information and culture. This economy

integrates new networks that, beyond new activities (specific

services, business creation), lead to better performance (energy,

industrial, environmental) through lean management and more

« smart » processes. Here the notion of supply chain appears

essential to the extent that manufacturers seek to pool their

resources, to create synergies, particularly by developing common

supply platforms to gain advantage over competitors.

How do these mutations take place in the countries? Take the

case of France and Germany. According to the Economic Analysis

Council (2015), France can rely on the strengths that constitute

a significant demand, the flexibility allowed by the status of the

auto-entrepreneur, an authority of experienced competition and a

proactive policy of access to data. On the other hand, it is lagging

on the supply side. The main reason for this situation is overly

rigid sectoral regulations and a poorly adapted financing structure

to minimize this gap, even to conquer a leadership position, France

must notably be tolerant with its sectoral regulations, in order to

boost the experimentation of new business models and promote

healthy competition.

Moreover, Germany has launched a major project to

digitize its industry since the end of 2012 in order to maintain

its competitiveness. The challenge for businesses is to move

from today’s centralized management of their production to

decentralized management. In the core of factories of the future,

faster, less energy efficient, more flexible, we find Internet

and a new discipline: cyberphysics. In industry 4.0, there is a

generalization of embedded systems, softwares, flow and data

management software. They must allow a better communication

between the machines and a better interactivity man-machine.

The observation thus established allows to better identify the

more serious issues, especially for the industry that is at the heart

of these changes both internally (optimization of organizational

processes, adaptation or renewal of the production tool) and

externally (changes in regulations, customer satisfaction).

Study of Socio-Economic Issues

On one hand, the digitization appears as a simple evolution

because of its very weak ripple effects on all sectors of economic

activity and on the employment, even if we can recognize its role

of catalyst in the third industrial revolution. The machine in some

jobs replaces man but, for all that, there is no increase in production

yields due to technical progress as in the 20th century. Gordon

(2016) believes that this revolution is not able to have impacts

with the same intensity as the two previous ones: « washing

machine contributed more to emancipation and quality of life than

smartphone ». « Elevator and refrigerator did more than Internet

». It only concerns communication and entertainment, at most

7% of GDP. Even the big data, used in marketing and technicalcommercial

services, would not have a significant scope. The

same is true for employment effects. Robert Gordon recalls that

the United States is today in a situation of almost full employment

which challenges us as to the reality of the shocks of digitization

of the economy.

On other hand, it is believed that the world is truly entering a

new technological era and prefers to highlight the many virtuous

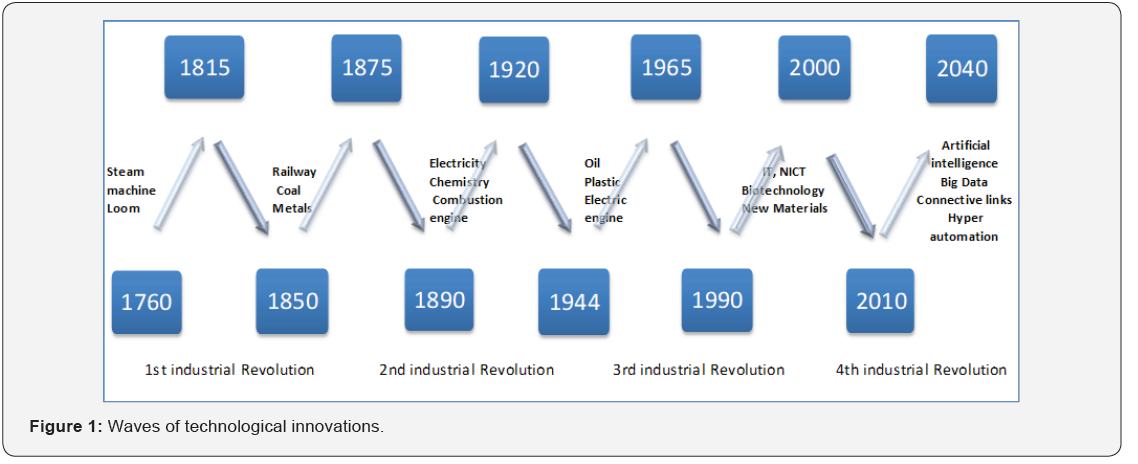

innovations. According to Joseph Alois SCHUMPETER, successive

shocks or waves of upswings and downswings have impacted

society and punctuated its transformations, since the birth of

industrial capitalism in the nineteenth century. Entrepreneur or

innovator is essential in Schumpeter analysis of the process of

development which is dynamic and discontinuous. Innovations in

one field of activities can induce other innovations in related fields

(Figure 1).

The Following Indicators Also Show that the Digital Revolution is in Processing

a. Increase in productivity gains, after a sharp slowdown at the

end of the « Thirty Glorious years » until the mid-1990s;

b. Creation of productivity gains in a very singular way in

services whose share exceeds 75% in the economic sectors;

c. Considering the energy constraint and the availability of raw

materials that has changed the perception of consumption

and renewal of resources;

d. Measure’s evolution of wealth’s level: from GDP to the HDI.

Wealth and industrial power could not be measured only

by business value added, social inequality or poverty level,

but also since the citizens’ willingness to build a fairer and

healthier society (system of health education, unemployment

insurance). In the sense of Amartya SEN (1990), the digital

does not escape these choices of access to knowledge and

leisure for all people with the development of more and more

« free » applied services;

e. Need or obligation of technological breakthrough for

businesses due to the preeminence of advanced computing

(artificial intelligence , exploitation of big data, exploitation

of cloud), also the proliferation of connected objects (link

between the physical object and the digital with the problems

related to the recovery of data as well as their processing and

storage), and then the democratization of advanced robotics

(cobots, collaborative robots, autonomous machines).

Similarly, the evolution of human-machine relations challenges

us: do need and use justify production when machine makes easier

access to information and decision-making? Permanently, the use

of network opens new perspectives to Internet users and implicitly

changes their behavior. Internet is the main model. Originally mass

media, nowadays social space where communication by text and

image is instant and unlimited, consequently it becomes a social

network (Facebook, Twitter, LinkedIn and more).

Consumer’s behavior as firm’s behavior has evolved in the

same way. All branches of industry have become those of the

NICT industries [5]. These last ones seek to better know the

customer to better satisfy him. Hence the demand is more volatile,

unpredictable, and the success of firms no longer depends on mass

production and the search for efficiency under cost constraint

through economies of scale, but the speed and flexibility of the

response to market demands with more personalized and higher

quality products. Industry should gain in competitiveness thanks

to new technologies (connected machines, additive manufacturing,

process digitization, cyber-production system).

Objects that are more and more connected are not worth their

own value, but rather associated services, most often in online

space. The challenge for businesses is to find even smarter processes

to adapt. In factories, performance management is measured by

the flexibility of production, the traceability of information in the

production process and energy savings. Contemporary economic

philosophy [10,11] reminds us that: we are currently experiencing

a period of immense change, comparable to the end of the Roman

Empire or the Renaissance. Our Western societies have already

experienced two great revolutions: the transition from oral to

written, then from written to print. The third is the transition from

print to new technologies, equally important. This change involves

major upheavals at all levels.

Upheavals and Emergence of a New Model

Technology is a factor of rupture, destabilization, change.

The importance of geopolitical upheavals or economic stakes is

in line with the strong and sustained growth of firms in the most

developed countries. Indeed, these large organizations stand out

in the world market by their financial weight, the multiplicity of

defended interests, the extent of production and distribution sites

and their spheres of influence, which are beyond the legal, political

and economic power of the host States.

In 2016, the technology sector outperforms the financial

sector as indicated by the PwC annual ranking of the world top

100 market capitalizations. GAFAM are in the first place among

American firms that remain globally the most dynamic and the

best valued in the world: they represent 54% of the top 100 firms,

ahead of those from China and Hong Kong (11%), the United

Kingdom (7%), Germany (5%), France (4%) or Japan (4%). Their level of market capitalization has more than doubled since 2009

reaching $ 16,245 billion in 2015 and $ 15,577 billion in 2016.

This figure is comparable to US GDP ($ 18,624 billion in 2016).

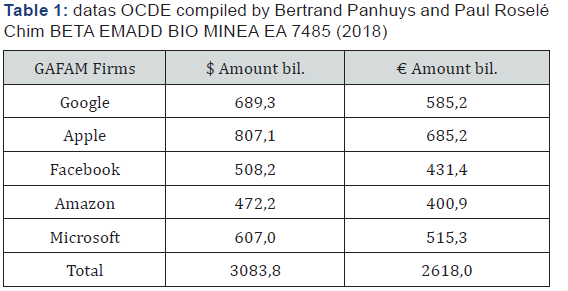

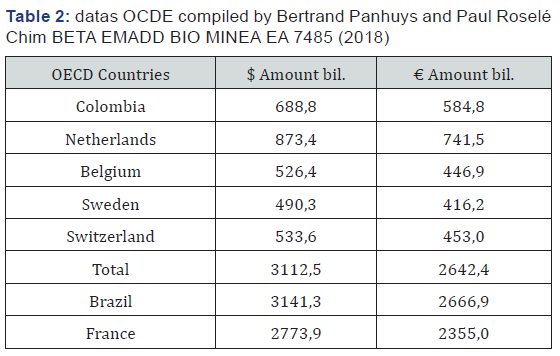

More specifically about the weight and influence GAFAM,

we can make the following comparison between their market

capitalization and the GDP of certain countries: Note that the

stock market valuation of Apple is slightly lower than the GDP

of the Netherlands, that of Microsoft is comparable to the GDP of

Colombia or exceeds that of Switzerland. Similarly, the financial

weight of GAFAM exceeds the wealth created by France and is at

the same level as that of an emerging country such as Brazil (which

produces a wealth superior to France of nearly 15%) (Tables 1 &

2).

Moreover, in the field of the Internet, we note that American

and Chinese firms also exercise significant power: The United

States account for 72% of the top 50 world sites against 16% for

China. The open path in this field and in those directly associated

with it (networks, IT, multimedia, etc.) suggests the emergence of

a bipolar world without the European Union [12]. By observing

the dynamics of European firms on highly technological and

strategic markets, we can notice the strong skills required in

digital technology. For example, in aeronautics (Airbus, Safran,

Thalès, Rolls Royce, Zodiac) or space (launchers, satellites) with

the operational implementation of the future Galileo geolocation

system competing with the American GPS, the multipolarite could

be preserved. European Union thus strengthens its position in the

global « representative » of Internet governance by influencing

political orientations and industrial strategies to better support

European firms in the digital transition.

Beyond the geopolitical stakes, a new model is setting up.

Firms now need « real time » signals from the evolution of

the market. They set up ad hoc processes that can collect and

interpret these information flows. The goal is not to miss the

next technical « disruption » a total break with the previous

phase as it generates radical changes. Disruptive innovation is a

breakthrough innovation, as opposed to incremental innovation,

which merely optimizes the existing [13]. Thus, the firms

potentially in commercial competition can form a network to work

in partnership, in order to increase the creation opportunities in

adequation with the expectations of the market. They also gain

in performance by using their internal resources and relying on

external resources in the fields of competence dedicated to each

provider. This is the rule of coopetition according to Rosele Chim

[8].

By revolutionizing organizational models and modes of

distribution, digital economy first imposes new ways of consuming

characterized by the « dematerialization » of consumer products.

The digital revolution disrupts certain business models in many

economic areas or traditional media [5,8]. It bypasses service

providers or formerly established intermediaries. As such, it

initiates a vast process of « disintermediation » which favors the

mediation of the new giants of the Net on the concerned markets.

This is the phenomenon of uberization of the economy according

to Bassoni and Joux [14,15].

The contemporary period is marked by an economic model

of products and services permanently free. This is a real cultural

and sociological revolution for users who no longer must pay to

consume their information assets: online newspapers and music,

radio shows in podcasts, TV, videos, movies in streaming. They

can now go on platforms to perform their transactions (Amazon),

to access applications (windows, iTunes) or to perform their

research or information (Google, traditional online media sites).

Greffe and Sonnac [16] consider that these platforms allow, on one

hand, to make quantitative and qualitative audiences available to

advertisers, and on other hand, to push for the development of

specific business models and dynamics. Here the success consists

in the ability of each to structure its users in communities offer

them services and tools that will facilitate their virtual social

interactions.

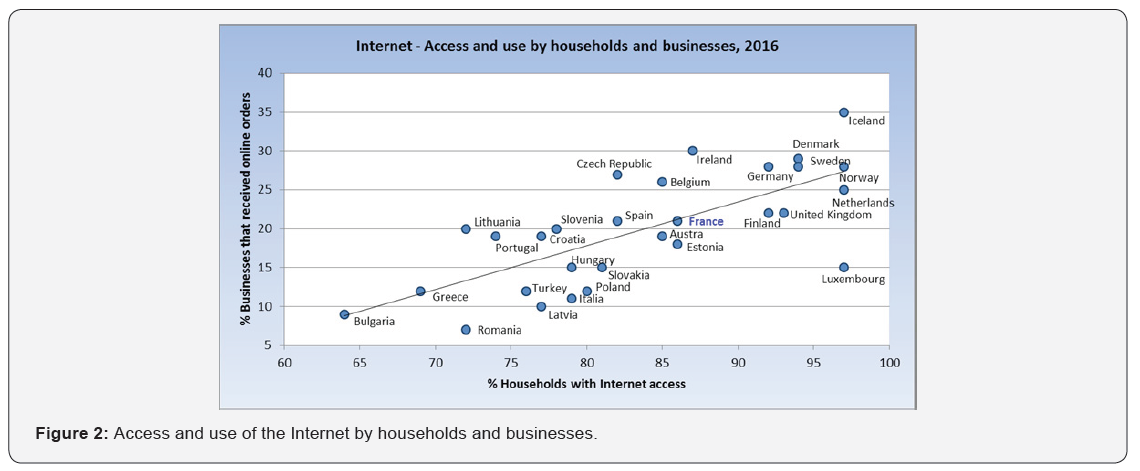

Countries also can take advantage of these

technological

advances by focusing on household equipment and encouraging

businesses to invest in Research and Development to make full use

of the new offered capabilities (e-commerce, client and supplier

data processing software, secure transactions) (Figure 2). The

chart above illustrates the digital divide between European

countries, with some not giving consumers or businesses the

opportunity to use new technologies to facilitate adaptation to

new models of trade, transactions and management. It is also

noted that it is mainly the more affluent countries of the North

which have fully changed in this new economy. As an example, we

can cite the success of the Israeli industrial model through its role as

active investor, its directive steering and a strong tax incentive

[17]. In fact, for nearly 15 years, the government has successfully

launched a $ 100 million venture capital fund to help create startups

and high-tech, high value-added projects.

Israel has become the first country in the world with the

highest ratio of R&D expenditures to GDP, far ahead of the United

States, the OECD countries and France. Israel has 4.3% in 2010,

against 2.8%, 2.3% and 2.2% for other countries respectively.

Finally, the consumption habits of citizens have been considerably

modified, demanding a strong and rapid adaptation of businesses

as well as their production process. Hence the emergence of a new

economic model where firms will develop another form of power.

The New Power of Firms

The movie and audiovisual programs industry in the United

States as well as in Europe, in addition to France, constitute

the illustrative field of firms constantly changing the strategic

alliances [18,19].

Business Strategy and Power of Market

The long history of industrial crises in the field of movies and

television highlights technical and technological transformations

that have triggered the disruption of NICTs [3,6]. We observed in

the 1980s, 1990s and 2000s a vast movement of concentration

in the world of the media. Behind the American Majors, like

the networks of Europe, the dynamics of the technological

clusters is intense. Controlling products and markets presents

several explanatory factors: evolution of technologies including

digitization and compression of signals; d e r e g u l a t i o n

which leads to the end of natural monopolies for the exploitation

of networks and the provision of telecommunications services;

transformation of the competitive environment that will drive

players to massively diversify their activities towards the

multimedia markets following the collapse of the traditional

sectors of the electronics industry; current situation due to the

growing interest of consumers for activities related to multimedia

and which require firms to adapt.

In fact, the new competitors appear from very different fields:

network infrastructures, IT, audiovisual, publishing, distribution.

These firms that emerge seek to control programs (contents)

and distribution networks (containers) as explained Guillou and

Mouline [20,21]. The phenomenon of globalization, the expansion

of cultural and informational consumption, the power of the

market and the maintenance of the content industries, has spread

to the cultural, informational and communicational industries

outside the world. Major firms have emerged by mastering the

tools and new uses of the web. As an illustration, in the field of

music, the popularity of iTunes, Apple Music, YouTube, YouTube

Music remind traditional firms how much they are dependent on

the decisions of the giants of the Net, which threatens again the

recorded music market.

The successes of these new world leaders come from their

ability to force users to use their application or materials.

The work of Kelly, Shapiro and Varian [22,23] shows that the

consumer will find himself in a system quite different from that

of traditional neo-classical economics. Its purchasing autonomy

is subject to sometimes strong constraints. Indeed, the user of

certain technologies can be « locked » without being able to easily

change technology.

Like most global markets, Internet has an oligopolistic

structure with businesses that, because of their ability to impose

standards, tend towards a dominant or even hegemonic position.

That allows to highlight three factors: drop in the costs of

technology, according to the MOORE law, permanent innovation

and intelligence. The cost of production of a smartphone is low in

view of the value of the components necessary for its manufacture,

in view also of the number of users as well as the applications and

operating systems developed and updated regularly in line. In this

context, we can understand that the movements of concentration continued with the development of Internet and associated

applications. Two main and indissociable reasons can be invoked:

on the one hand, the added-value chain linked to content and

the resulting wealth creation capabilities; on the other hand, the

structuring of the production of the containers and the search for

management optimization of trade flows and logistics necessary

for the distribution of final goods.

In fact, overall satisfaction depends both on the quality of the

products and services adapted to the expectations of consumers

and the organization of the market. For these leading firms,

purchasing has become a source of productivity. Because buyers,

faced with the multiplicity of information channels and orders,

want to see more complementarity between tools and better

harmonization of data collected by the company. Thus, the supply

function has evolved while allowing to provide innovative and

quality products, and avoiding stockouts, elements both costly for

the company and negative in terms of image and notoriety. It is

from now on the whole chain of value that the company considers

in the evaluation of its performance. It adapts in an almost iterative

way, according to the cycles of production and the evolution of the

competitive environment, all its processes for the realization of

the fixed objectives.

In this context, the control of costs or delays as well as the

control of the quality or the reliability of the final production

remain; but other indicators are also used to measure the success

of the corporate strategy: customer loyalty, improvement in

economic performance (sales, operating margin) or financial

performance (profit per share), promotion of image or brand,

innovation (R&D budget, collaboration with research laboratories,

patents pending), internal and external growth prospects for the

company (unprofitable activities outsourcing, key skills current

or future strengthening by training or recruiting the necessary

talents, positioning on international markets).

The situation we have just described makes it possible to

better understand the market power of these new players who,

taking advantage of the high expectations of consumers, manage

to make them captive. Nevertheless, other elements that did not

exist in the previous revolution must be considered to ensure their

strategic power: networks and empowerment.

The Era of Networking and Empowerment

Through networks, firms can adopt strategies to diversify their

activities. This allows, on the one hand, to erect barriers to entry

against potential competitors. According to Stigler [24], a barrier

to entry is a cost of production that must be charged by a firm

wishing to enter a market, without those already in place having

to do it. This offers the opportunity, on the other hand, to set up an

investment policy whose profitability is more secure. In fact, the

risk of loss is reduced because of the holding of a larger products

portfolio and profit prospects discounted on other markets. Megafirms

correspond to a global market and millions of captive users.

For the third type of firms after the multinationals, the

most important is not so much the gain in market shares as the

network constituted by the number of users who fuel the need for

development of closed mobile applications to the Internet service.

Competition is no longer at the level of the operating systems

but more platforms with data become permanent: innovation,

alliances, searching for external growth. Facebook confirms

it; according to manager Mark Zuckerberg, performance goes

through a more open and connected system.

Thanks to the increased use of digital channels and common

platforms for data exchange and processing, B2B is constantly

growing. Similarly, on the consumer side, the more widespread

use of Internet strongly influences exchanges between individuals

(online sales and purchases). « GAFAM deal with the same users

but with its own assets: mobile terminal, research browser,

advertising browser, cloud platform, community of developers »

according to Bourdin [12].

Nevertheless, several characteristics of these markets on

which these large firms are positioned, make it possible to

measure well the difficulties to maintain a stability of networks

and a continuous growth: First, they are hyper fragmented and

heterogeneous. Then the situations of dominant positions are

very quickly jostled because of the pressure of new entrants or

substitutable products. Lastly, product cycles are very short and

innovation processes are constantly improving. It is the result of

the search for creativity and permanent innovation that ultimately

leads to the development of new services and new markets. All

this poses significant risks to the market equilibrium and pushes

to question the means of regulation.

The Risks of Imbalance and the Search for Regulation

The 2007 crisis demonstrated the complexity of business

relationships, the inability to master information flows or to

predict the onset of a collapse of a growth and confidence-based

system. With the advent of digital technology, we can wonder,

beyond its beneficial effects on global economy, on its capacity

to create growth through technical progress and to ensure

an increase in social well-being. Finally, the combination of

financialization, digitization and globalization would constitute all

the explanatory factors for the deregulation of the system, with

each element allowing the other to increase its intensity and its

propagation.

The Relation Between Technical Progress and Growth

Many firms, like the media groups or giants of the

Net,

have gone through economic and organizational crises, forcing

them to reinvent themselves to survive Bassoni and Joux [15].

Businesses must constantly adapt their production model to

market developments. This external environment can be at

the same time very close (local market) or very distant (global

market) but impose very strong constraints to be considered in

the development strategy. According to Bassoni and Liautard [14], the

territories bear the stigma of the « creative destruction » that

Ja Schumpeter [25] explained. They are, over time, the theaters

where two concomitant and inextricably linked processes take

place: that of the decline of traditional activities and the rise of

new activities ».

This trend is well underway and affects all sectors of economy.

But a fundamental question arises: will this digital revolution

increase the productive capacity or, on the contrary, as Cohen

[26] asserts, that it will not bring anything comparable to the

technological revolutions related to the invention of electricity and

combustion engine? The report of slow economic growth observed

for thirty years in the United States, with a median income that no

longer progresses despite the arrival of digital technology, would

rather support the second thesis. The firm no longer creates

enough added value for the employment of additional staff and

for training effects in other economic sectors since it outsources

activities to subcontractors in a massive way.

In addition, compared to previous periods, the contribution of

technological progress generates insecurity by replacing jobs with

robots, with automation chains, with intelligent processes. 50%

of jobs would be threatened by the development of digitization. It

is the middle classes, the banks, the insurance businesses and the

administrations, which seem the most exposed by this evolution

of the employment because of the increase, on the one hand, of the

need of labor poorly qualified to carry out basic tasks and on the

other hand, of important resources released by and for those who

are behind this digital transformation. In the United States, 1% of

the richest people have seen their share in the GDP increase of 15

points in thirty years.

The challenge for the future is no longer to increase the

productivity of men at work (lower than in the 20th century),

robots and computers replacing them, but to redistribute the

profits and above all, to raise the level of well-being of all (education,

health, eco-citizenship, eco-transportation). The economic sphere

is turned to producing not goods but applications that provide

users with free information. As a result, what is of value it is what

escaped this free, it is the positional goods: where I live, or I send

my children to school, can I be healed in good conditions [26]. In

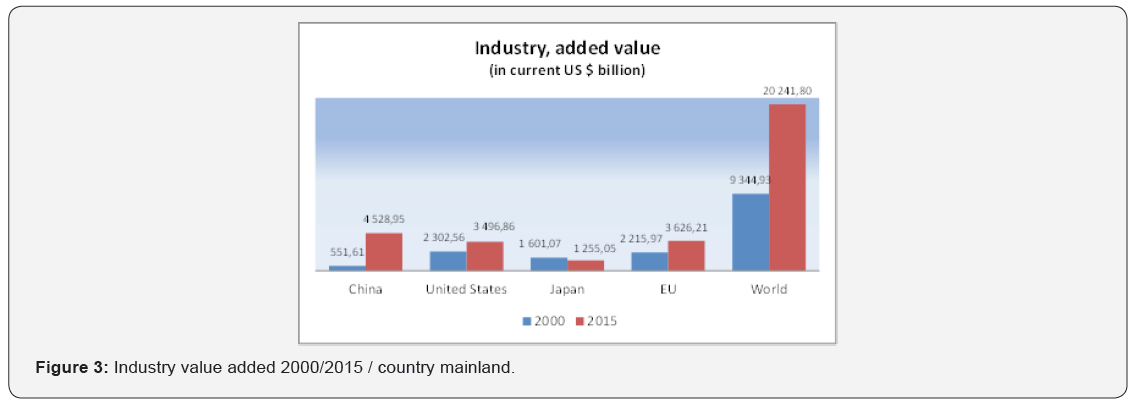

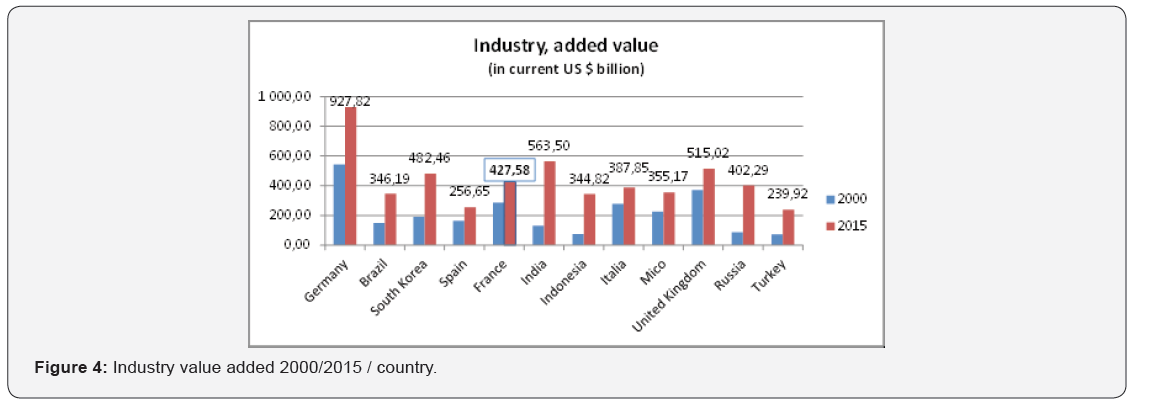

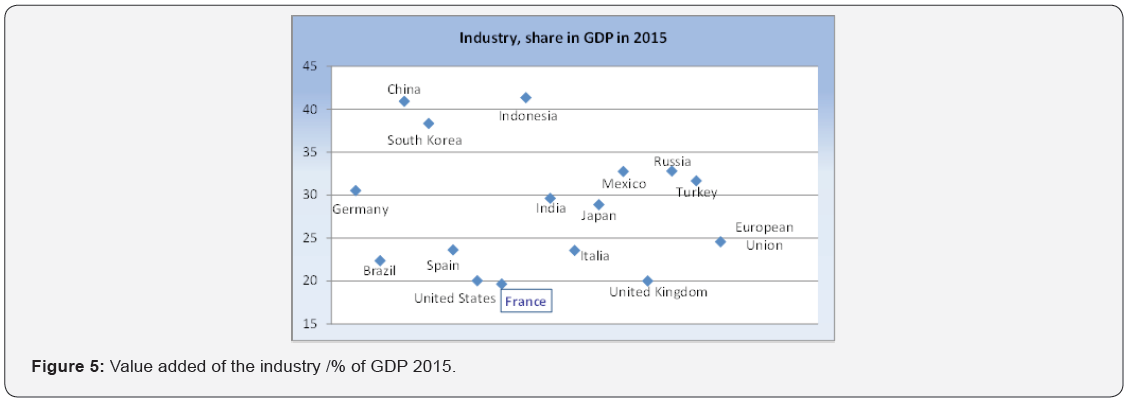

this context, France has made the implicit choice for three decades

of an economy without industry. In the charts below, we can

observe the place that France occupies among the industrialized

countries in the world and in Europe (Figure 3-5).

We can admit that between 2000 and 2015, the process of

industrialization concerns emerging countries and especially

China, which alone exceeds $ 4 500 billion in value added. The

BRIC group has recorded very strong growth, unlike European

countries which have not developed their production tools. South

Korea, in full industrial transformation, has managed in 15 years

to exceed the value added of France, Russia, Mexico or Indonesia.

This dynamic is explained by the importance of the share that some

countries devote to industry in GDP: over 35% in China, Indonesia

or South Korea, 30% in Germany, Mexico or Russia, France being

below 20%, like that of the United States or the United Kingdom.

In view of these elements and the trends that emerge, several

questions arise. The digital revolution and the challenges it poses

are not an opportunity for the implementation of a process of reindustrialization

and revitalization of businesses turning to more competitiveness. Will this revolution have the capacity to relocate

industrial activity that has disappeared to the extent that factories,

which have become more flexible and automated, have production

costs that are almost « insensitive » to the cost of labor?

Indeed, the previous revolution had put more on an increase

of the volumes to justify the economic investment and to increase

the production, the size and the costs of return of the businesses.

Today, the theoretical growth factors are based, at constant product

volumes, on the reduction of capital consumption and a return on

investment from higher capital employed. Nevertheless, thanks to

2008 crisis, the direct effects of digitization have been significantly

accentuated. It is the rise of unemployment, precarious jobs, the

decline in average wages, the growing deficit of foreign trade,

the obstacles to growth, the devitalization of territories, the

increased vulnerability of society. The sustainable development is

considered in some extent by a production turned to employment.

Indeed, the industry includes a mode of distribution of wealth

through the wage system, while the NICT model does without it by

accentuating the unemployment of performance and competence.

Six Orientations are Advocated

a. support creativity and human development through

the modernization of the education system, valuing the

imagination and taking risks;

b. develop economy based on quality and provided services;

c. renew the energy model and master consumption for all and

sustainably;

d. initiate a « big bang » of territories (mobilizing and structuring

projects);

e. put finance at the service of growth;

f. strengthen global influence capacity by improving the

competitiveness of firms and by acting within Europe to

rebalance competition between emerging countries and the

first industrialized countries.

g. These guidelines challenge the sustainability of development

and governance: govern differently to produce otherwise.

GAFAM and other high-tech companies have accompanied

digital change. It is a question of working in a transversal way in

collaboration with the actors of the market to advance the scientific

research, the development, the applications at the service of the

product. The goal is to move towards some form of social welfare

of individuals.

Global Competition, Strategic Coopetition and Risks of Collusion

Beyond the problems related to competition, there is the

question of the sharing of added value between the different

actors: service intermediaries (Facebook, Google), incumbent

operators (Orange, British Telecom), network and terminal

equipment manufacturers (Alcatel Lucent, Dassault System),

content producers (Disney, AOL-Time Warner, Newscorp). The

emergence of GAFAM and their mega-power was built through

major breakthroughs: hardware (Apple), search (Google),

e-commerce (Amazon), social (Facebook). Industry 4.0 offers

new perspectives of digital applications for the benefit of citizens,

customized products, needs and specific markets.

The search for an optimum of satisfaction goes through

the development of business networks, common platforms of exchanges, partnerships between the academic and scientific

world and that of companies, multiple collaborations in order to

answer the economic and societal problems. The stakes are up

to the challenges that we perceive in the 7 industry paradigms

4.0 described by Blanchet [27]: management of the complexity

induced by digitization allowing the customization of products

; industrial relocation near final markets with high automation

production processes ; dynamic and more efficient supply chain

(lean); end of the product-service divide and supplier-customer

reconciliation thanks to the data collected and which allow to

improve the quality of service and to optimize the life cycle; end of

the logic of an economy of scale, the new technologies implemented

mobilizing the physical asset more and allowing the passage from

a « push » logic (to manufacture to store) to a « pull » logic (to

make on command); end of Taylorism with learning organizations

and increased reality technologies (increased monitoring, remote

work, tele maintenance, remote factory inspection). more energyefficient

industry (circular economy), better integrated in its

territory of implantation (CSR approach) and more attractive [28-

31].

The coopetition practiced by most big firms that provides a

balance of power should gradually fade in favor of more intense

competition due to the increased development of networks, clouds

and big data. In this context, how to ensure balanced competition

for the benefit of consumers? The arrests, interrogations and

hearings in front of the institutions in the United States and the

recent trials in Europe against the GAFAM show the limits of the

digital economy where the influence of firms and markets exceeds

the power of States. Which regulatory instruments to implement?

Regulation Instruments

According to neo-classical economics, and particularly the

school of industrial organization, it is necessary to think of the

necessity of reinventing a more socially model of growth just by

integrating the future generations, more economical and more

durable. This seems conceivable in the evolution of economic

thinking, of industrial analysis, which is gradually considering the

human approach of the aleas of the conditions against growth. It

places greater emphasis on the training of precarious populations,

namely unemployed and unskilled, on the emergence of new

skills, on social innovation and on the optimization of available

resources in the light of the consumption [32-35].

Another vision encourages us to put forward rather the

voluntarist strategy aiming at the search for the competitivity of

the companies at the local scale of the territories to integrate in the

model of regulation all the societal evolutions. Thus, countries and

regions can exist in terms of industrial weight and have influence

in terms of geopolitical weight at the global level. Economic poles

in globalism would favor the emergence of high value-added

technologies sold in the world. Hence the questions about the

nature of the businesses in the future, their organization, their

production, their market and their process of survival [36-38].

The dynamics of liberalization is at the heart of digital economy

that cannot seek to control markets and firms whose field of action

is supra-national. There appears to be a temptation in the global

market between the return to protectionism on one side and the

intensification of liberalization on the other side. Indeed, there are

counter-powers to the large influence of digital economy:

the consumer is first, versatile and communicating globally via

networks and potentially sensitive to the image of the firm in case

of repeated and notorious; the competition is then stronger and

focused on innovation, structural and partnership organization;

the regulator is finally, on the lookout for any risk of technical, legal

or financial imbalance to guarantee an optimum of satisfaction to

the consumers and more broadly to the society [39-42]. This is a

form of declining general equilibrium with the Paretian optimum

since more CSR logic is considered with respect to the external

environment. And we find corroborated the principle of the

research of the balance between the industrial regulation and the

innovation [43,44].

Conclusion

The digital revolution has effects on all areas of society.

Consumption habits have been modified, pushing companies

to adapt their mode of production. GAFAM and new types of

companies from the Internet and the high-tech sectors stand out

thanks to their own identity and their capacity for innovation.

The power and influence of these organizations is significant

in achieving the balance of fragmented, heterogeneous and

volatile markets due to competitive pressures and ongoing

innovations. Liberalization is faced to protectionist temptations.

The context challenges the rationalization of organizational

models and productive activities, the mode of job destruction,

societal involvement and the method of profit compilation. States

are grappling with the model of digital economy and the dynamics

of a new type of industrial organization through the protection of

citizens (Google), the avoidance of instrumentation (Facebook),

the ecosystem predation (Amazon), the tax avoidance (Apple,

Google, Amazon, Airbnb). Adaptations are long term. The changes

are important.

For More Articles in Annals of Social Sciences & Management studies Please Click on: https://juniperpublishers.com/asm/index.php

For More Open Access Journals In Juniper Publishers Please Click on: https://juniperpublishers.com/index.php

Comments

Post a Comment