A Review of Impact of Government Expenditure and Bank Credit on Agricultural Productivity of Nigeria-Juniper Publishers

Annals of Social Sciences & Management Studies-Juniper Publishers

Abstract

This study reviewed impact of government expenditure and bank credit on domestic agricultural sector output in Nigeria. It used OLS regression analytical method to evaluate relationship between agricultural output and several factors influencing agricultural productivity in Nigeria such as government expenditure to agriculture, bank loans and advances to agriculture and index of agricultural production. Results showed that there existed a negative and significant relationship between government expenditure and agricultural output in Nigeria, while banks credit to agriculture and index of agricultural production had a positive and significant correlation with agricultural productivity. The study therefore recommends an increase in government expenditure to agricultural sector to counter its negative effects or trends over the years to raise agricultural output and thereby beef up growth of the domestic economy. Besides, banks should continue to extend domestic credit to the agricultural sector in a bid to continue to boost index of agricultural production and rise real growth in the economy generally.

Keywords: Government expenditure; Bank credit; Agricultural output; Index of agricultural productivity

JEL clarifications: Q13, Q16, Q18

Introduction

The Nigerian agricultural sector had traditionally been expected to fulfil such roles as providing food for the growing population, generate foreign exchange earnings, employ part of the teeming labour force and provide income for the farming households. The contribution of the agricultural sector to the value of the national output otherwise called gross domestic product (GDP) has been relatively low over the years, averaging less than 40 percent during the 1980 - 1998 period (CBN, 1998a). Although, the agricultural sector accounted for 60 – 70 percent of the non-oil export value, its contribution amounted to less than 10 percent of the total export per-annum recently (CBN, 1998b). Empirical evaluation of food supply by the Nigerian agricultural sector has been somewhat mixed results. However, the food import bills, which grew from N58.50 million in 1970, N1,106million in 1978 to 102,165million in 1998, respectively (CBN, 1998b), had suggested a growing inability of the agricultural sector to meet the domestic food needs of the country [1,2].

Besides, total government expenditure as a percentage of AGDP measures the amount a country spends relative to the size of its economy. On average, developing countries spent much less than developed countries. For examples, total government outlays as a percentage GDP in Organization for Economic Co-operation and Development (OECD) countries ranged from 27 percent in 1960 to 48 percent in 1996 [3], compared to 13 – 25 percent in most developing countries. The total expenditures could be divided into recurrent and capital expenditure. Recurrent expenditures were made up of all “comsumption” items such as goods and services, personnel costs, overhead costs, etc. while capital expenditures included all expenses which contributed to long-term development like spending on national priority projects, social and economic infrastructure, etc [4]. As a matter of fact, agriculture occupies a priority status in the national economy. The National Economic Empowerment and Development Strategies (NEEDS) as well as the States’ Economic Empowerment and Development Strategies (SEEDS) identified the agricultural sector as a key driver of growth wealth and poverty reduction [1]. In line with this profile, NEEDS defined public expenditures in agriculture as poverty – reducing and growth promoting.

Again, another important area begging for reform is the funding (fiscal outlook) of agricultural development in the country. Even though agriculture has been on the concurrent list (that is, a simultaneous responsibility of the three tiers of government – federal, state and local), it has been a comparatively neglected sector in terms of productive investment. Agreeably, agriculture is the largest sector in many developing countries of the world. More importantly, the majority of the world’s poor lived in rural areas and they had primarily engaged in agriculture. Therefore, agricultural expenditure could be said to be one of the most important government instruments for promoting economic growth and alleviating poverty in rural areas of developing countries [1,2].

Agricultural expenditure as a percentage of agriculture GDP measures government spending on agriculture relative to the size of the sector. Compared to developed countries, agricultural spending as a percentage of agricultural GDP was extremely low in developing countries (Nigeria inclusive) as earlier mentioned elsewhere in this study. The former usually has more than 20 percent, while the latter averaged less than 10 percent. In Africa, agriculture expenditure as a percentage of agricultural GDP remained at relatively similar levels (7 - 8 percent) throughout the study period (Dayo, 2001 & Okhuebor, 2008). About two-thirds of African countries decreased agriculture expenditure relative to agricultural GDP. Asia’s performance was like that of Africa, as its percentage remained constant at 7.5 – 9percent. For Latin America, agricultural spending as a percentage of agricultural GDP hovered around 4 – 13 percent during the 1980 – 1998 season [5,2]. The share of total government expenditure on agriculture had provided important information on whether the agriculture sector received biased treatment under macroeconomic adjustment programmes. For all countries in the study, the share gradually declined from 12 percent in 1980 to 9 percent in 1998, respectively.

The share has been constant for Africa, indicating effect of macroeconomic adjustment programmes on agricultural spending. In Asia, the share has declined from 15percent to 10percent. Latin America experienced the most rapid decline in its share, from 8percent to a more 3percent, during the same period [5].

Among all types of agricultural expenditures, agricultural research and development (R&D) had been the most crucial to growth in agricultural and food production [6], showed that agricultural research and development expenditures as a percentage of agricultural GDP, saw a relatively stable increase in the last three decades. For examples, in 1995, the share of agricultural R & D expenditure in agricultural GDP in Africa and Asia was between 0.53 – 0.85 percent and in Latin America, it was 0.98 percent. These had been relatively low compared to 2-3 percent in developing countries [1,5,6].

Again, Pakistan is a developing country its agricultural sector policy is like that of Nigeria. In Pakistan agricultural sector plays an important role in its economic growth and development to the extent that agriculture is said to be the largest economy in Pakistan, accounting for 60% of its gross domestic product [7]. It is said that modern agriculture is necessary for economic development. When farmers are provided with credit for the purchase of modern inputs, it would be possible for them to adopt modern agriculture. Many developing countries to which Nigeria and Pakistan belong, have recognized the benefits of using modern agricultural technology.

However, the use of modern technologies to increase agricultural production also increases farmers’ financing needs to which they must be helped by both public and private sector credit providers. Easy and cheap credit has been the fastest way to promote agricultural production. Credit is an important tool that provides emergency relief to the farmer, such as the purchase of seeds, fertilizers and livestock [7-9]. Agricultural credit has been playing a key role in the crop production and use of industrial products in the agricultural sector. In the economy of Pakistan, the major sources of agricultural credit are Zarai Taraquiati Bank Limited (ZTBL), that may be likened to agricultural development bank in Nigeria, commercial banks and cooperatives [7,10].

Agricultural credit is considered the backbone for any business, and it has always been a non-monetary activity for the rural population of the Pakistan. Agricutural credit is an integral part of the process of commercialization of agricultural modernization and the rural economy. Easy and cheap credit represents the fastest way to improve agricultural production. Therefore, previous governments have always made it a priority to meet the credit requirements of Pakistan’s agricultural communities [7]. As a sector, agriculture depends on seasonal changes more than any other economic sector as farmers’ purchases shift from commercial agriculture to necessities, like clothing and food. Credit may provide them with the opportunity to make more money and improve their living standards [7].

Agricultural credit is seen as one of the strategic resources of crop production, which has led to increase in the standard of living for Pakistan rural poor agricultural society. Therefore, it plays a significant role in economic growth and development of the nation. In Pakistan, there are two main sources of agricultural credit: informal and formal. Informal sources usually include commission brokers, input suppliers, shopkeepers, friends and relatives, as it is also in Nigeria. Out of these sources, credit from commission brokers, shopkeepers and input suppliers has been more detrimental to the rural poor. There is evidence that such loans further aggravate the effective rate of informal loans, making the loans too expensive for those living in rural poverty [11].

The importance of credit availability can be illustrated by the fact that the input expenditure per hectare requires farmers to provide proof of credit, regardless of whether their level of asset is significantly higher than the credit they are seeking. High input spending may be related to higher productivity and growth. The impact of credit on the Pakistani institutions of agricultural production has been recognized as positive and significant from past studies [9,12].

In developing countries, the agricultural production is low, especially in Pakistan due to smallholdings, traditional methods of farming, poor irrigation facilities and low or misuse of modern agricultural technology [12]. Low agricultural production often results in not enough income being generated or small incomes. Thus, it is necessary for credit agencies to come in and help farmers to apply and improve agricultural practices. Credit is an important tool for farmers to obtain in order to make use of their working capital, fixed capital and consumer goods [13]. Credit has vital role for increasing agricultural production; and timelyprovision of credit allowed to farmers to purchase the necessary inputs and machinery for farm operations [14].

Statement of the Problem

According to Policy Brief No 2 of the Technical Assistance to the House of Representative Committee on Agriculture [15], there has been mounting evidence of under investments in agriculture in the country and misallocation of public funds across subsectors. In line with that report, the contribution of agriculture in GDP growth exceeded the share of public expenditures allocated to agricultural public goods, including research and development which has been known to yield high returns to investments. The basic problem is that there was an imbalance between what agriculture contributed to the economy and how much public funds it received.

Agriculture sector funding often comes from the federal government, state government, organised private sector, informal sector and international development partners including bilateral and multilateral agencies. Perhaps, because the society saw agriculture as a small farmer activity, less than 1 percent of Nigeria’s annual GDP was ploughed back into agriculture as productive investments. Over the years, agricultural sector has suffered inadequate and unstable funding from the government. At the federal level, agriculture expenditure has been very erratic [1].

In the past, public sector spending into agriculture has not produced the desired results. One major weakness of agricultural sector spending has been the large incidence of unintended beneficiaries. Examples of wrong targeting and ineffectiveness of public spending have been many. For instance, while fertilizer subsidies were often intended to benefit small scale farmers and achieve increased crop productivity, the unintended but real beneficiaries have been rent-seeking government officials, fertilizer merchants and agents. As an illustration, the Central Bank of Nigeria reports (1998a, 1998b), showed that in 2001, fertilizer price ranged from N1500 – N2500 as against the official subsidized price of N1000. In the year 2000, the sales price averaged N2000 despite the official subsidy price of N900. With all these disparities in government agricultural funding and its impact on agricultural productivity of GDP over the years, the need has arisen for the present study to determine the true about the issues in question.

Again, notwithstanding all these teething problems yet to be resolved, a recent study by [16], on effect of government agricultural funding and bank credits to agriculture, reported a positive and significant impact on agricultural productivity. At the foreign front, a study by [17], on agricultural credit and economic growth in rural areas of Alabama, United States, also found a positive association between agricultural lending and agricultural GDP growth per rural resident with additional billion in loans (about a third of the actual average) associated with 7 – 10 percent higher state growth rate with this association stronger during the 1990s. Regional data confirmed these results. The result pointed to a positive link between credit and economic growth in rural areas during that period, attributed to the lending farm credit system (FCS) institutions and by commercial banks.

However, a study by Okhuebor [1], on impact of government expenditures on agricultural GDP found a negative and significant association between government expenditure and agricultural GDP growth or output. The disparity existing among these three studies has necessitated the need for the percent study to establish the true position of things in Nigeria about agricultural funding, (credit) and growth of agricultural productivity. By the time this study is completed the researchers shall be able to ascertain if government expenditure has positively and significantly impacted on agricultural output in Nigeria or not.

a) Examine impact of government expenditure on agricultural sector productivity or output of Nigeria.

b) The study would determine the nature and magnitude of the relationship between bank credits to agriculture and Nigerian agricultural sector output

Following these two above stated objectives this study would intend to provide answers to the following questions to guide research thus;

a) To what extent has government expenditure impacted on agricultural sector output of Nigeria?

b) To what magnitude has bank credit impacted on the agricultural sector productivity of the domestic economy?

Hypotheses

To achieve the set objectives for this research, the present study would test the following hypotheses in their null format thus;

Ho1: There is no positive and significant impact between government expenditure and agricultural sector output

Ho2: There is no positive and significant association between bank credit to agriculture and agricultural sector output of Nigeria.

Literature Review and Conceptual Framework

Conceptual framework

Conceptually, it is generally believed that adequate funding of agriculture in Nigeria would lead to growth of agricultural output and engender economic growth since the country has enormous land mass that is fertile for agriculture. Nigeria situating on a tropical region of West Africa subregion has a good weather, seasons of rainfall and dry season for between 5 – 6 months alternating with each other, with many tropical farm crops and economic trees like yam, cassava, cocoyam, groundnut, wheat, plantain, maize and palm trees, coconut, rubber, etc that make for high yields and harvests all the year round but for poor funding by both government and the private sector. The land is also good for animal husbandry

The situation has been worsened since the discovery of crude oil in Olobiri of the Niger Delta region in the late 60s leading to huge inflow of oil wealth that made past Nigerian governments and her people abandoned farming and neglected funding of agriculture thereby leading to its insignificant contribution to productivity of the Nigerian economy. Agriculture been the life wire of the country in the 1950s and 1960s until 1970s to-date, if it is revived and well funded as the present APC government of President Muhammadu Buhari, has been trying to do, would increase not only national agricultural output but it would also lead to growth of the Nigerian economy generally. It was based on this premise that the present review study was built. When completed the researcher shall be able to judge if its conceptual framework or underpinning is worthwhile or not.

Literature Review

The Role of agriculture in national output and economic growth of nigeria

Before delving into the role of agriculture in an economy proper, it is pertinent to just and foremost, give a brief definition of the term – agriculture.

According to, Anyanwu [18], agriculture involved the cultivation of land, raising and rearing of animals for the purpose of production of food for man, feeds for animals and raw materials for industries. It also involved cropping, live-stock, forestry and fishing, processing and marketing of these agricultural products.

Abayomi [19], like many other economists, said that in most developing countries, agriculture has been both the main traditional pursuit and the key to sustained growth of the modern economy. She also noted that economic growth has gone hand in hand with agricultural progress, stagnation in agriculture was the principal explanation productivity has been the most important concomitant of successful industrialization. Among the roles conventionally ascribed to the agricultural sector in a growing economy are of providing adequate food for an increasing populations; supplying raw materials to a growing industrial sector, constituting the major source of employment, earning foreign exchange through commodity exports and providing market for the products of the industrial sector.

Ogunfiditimi [20], contended that up till the late 1950s, agriculture contributed over 60 percent of Nigerian GDP. Its percentage contribution, however, has fallen drastically in recent years due, in part, to the boom in the petroleum industry. The oil boom, notwithstanding, the agricultural sector still provides employment for over 70 percent of the Nigerian population. Apart from provision of the means of livelihood to farmers, it creates job opportunities for people who serve the farming and agro-allied industries within the country.

Ukpong & Nafisat [21,22], reiterated that in view of the importance of agriculture mentioned above, most public policy makers, especially since independence in 1960, had expected the sector to ratify the bulk, if not all, of the food requirements of the country and to supply most of the agricultural raw materials needed by the manufacturing sector. This area has been in the mind of the present Head of State, Muhammadu Buhari, since he assumed office in 2015 to-date, trying to ensure that funding and revival of agriculture take a proper shape to rise contributions of agriculture to relevance sectors of the national economy.

Reynolds [23], stated that agricultural development could promote economic development of the under-developed countries in four distinct ways;

a) By increasing the supply of food available for domestic consumption and releasing the labour needed for industrial employment.

b) By increasing the supply of domestic savings, and

c) By providing the foreign exchange earned by agricultural exports.

In addition, Manyong, Olayemi & Ikpi [24], established that in most developing countries, agriculture has been assigned an important role in nation development. Also, agriculture has been a means of reducing dependence on certain importation, curtailing food price increases, earning foreign exchange, absorbing many new entrants to the labour market and increasing farm income at times of severe unemployment and rural poverty

Agreeing with the above views, Meyer [25], wrote that the appraisal of agriculture contribution or role in the national economy could be made by using four primary criteria, namely;

a) The proportion of the population engaged in agriculture,

b) The share of agriculture in the gross domestic product,

c) The proportion of the nation’s resources (other than labour) devoted to or employed in agricultural production, and

d) The contribution of the agricultural sector to foreign trade.

Following these criteria, Anyanwu [18], noted that Nigerian agriculture has, in recent years, not been able to meet the food needs of the country. Rather, food production per capita has been declining. To complement the low domestically produced food supply; there has been a substantial rise in food imports. These have taken substantial portions of the much-needed foreign exchange for importing capital for development purposes. Available data revealed that average food imports have accounted for about 9.15 percent of total imports over the period between 1960 and 1993 [1]. Nigeria’s quick turn from a low food importing to a high food importing country with food bill accounting for 14.71 percent of 1991’s total bill compared with 6.87 percent in 1970 was an ugly sign of collapse of the agricultural sector. Anyanwu [18], therefore also noted that his situation did not augur well for the Nigerian economy especially when it has been realised that there were available resources that could have been exploited to increase the local production of food stuffs.

Finally, Rehman, Chandio, Hussain & Jingdong [7], used an econometric analysis to investigate relationship between agricultural gross domestic product (AGDP) and variables, such as total food production, cropped area, loan disbursed by ZTBL, cooperative loan and total loans disbursed by various institutions in Pakistan. In their concluding remarks, they re-asserted that the agricultural sector of Pakistan has remained the main economic sector and contributed to about 60% of the country’s GDP. That production in the agricultural sector has been the main revenue source for the overall economy of Pakistan. However, with time, the agricultural sector declined significantly due to its inability to keep up with technological developments.

The study results revealed that the total food production, ZBTL loans and total loans disbursed y various institutions had a positive and significant influence on the AGDP, whereas cropped area and loan disbursed by cooperatives had a negative and insignificant influence on the AGDP. Based on their results, they recommended that Government of Pakistan should formulate and initiate new policies and funding schemes for the development and improvement of the agricultural sector. When the present study is completed , the researchers shall be in a vantage position to ascertain if their findings of research and recommendations thereupon would draw from their Pakistani counterparts, noting that since 2015 to-date, when the government of President Muhammd Buhari came to power, there has been agricultural revolution or rather explosion in Nigeria leading to rise in agricultural productivity ever since.

Empirical studies on government expenditure and agricultural productivity

This section carried out a brief review of studies on government expenditure to agriculture and performance of agricultural sector output generally along these lines below;

Agricultural finance and agricultural production

Several past studies have been conducted to examine impact of agricultural finance on agricultural production in both developed and developing economies. A number of these studies [12,26,27], established that bank credit had a positive effect on economic growth and development. In particular, Zuberi (2008), discovered that 70 percent of the overall credit to the agricultural sector was used in fertilizer and seed purchases and he submitted that the majority of the increased agricultural production could be attributed to changes in quality and quantity of fertilizer and seed [16].

Siddiqi, Mazhar-ul-Hq & Baluch [26], reported that the flow of fund accessed by farmers was found to have increased inputs demand for the sole aim of increasing crop production. Besides, irrigation, the elasticity of credit amount, the use of chemical pesticides and fertilizer and number of tractors, etc. with respect to agricultural income as the dependent variable on per cultivated as well as per cropped acre basis revealed that credit for production and tube wells had a positive and significant impact at 95 percent level of confidence.

Another study by Afangideh [28], on the investigation of the several networks by which financial development was being channelled to the agricultural sector, and it also examined the effect of the financial sector development on the agricultural output and investment of the agricultural sector using aggregate data from 1970 – 2005 and Johnson cointegration and Engelgranger two – step approaches. The result of this study showed that positive and significant relationship existed between bank lending to agriculture and agricultural sector real output. The paper therefore recommended that emphasis on investment in the agricultural sector should top the agenda of financial sector development as a primary focus on economic diversification by Nigerian governments.

Finally, Enya & Alimba [27], examined effect of commercial bank funding on Nigerian agricultural sector from 1986 to 2005 using OLS multiple regression methodology. The study’s results discovered that agricultural sector repayment ability, cash reserve ratio and interest rate had the theoretical right signs indicating that an increase in interest rate and repayment ability of the agricultural sector caused an increase in the amount of bank credit to the agricultural sector while cash reserve ratio increases tended to decrease commercial bank funding to agricultural sector of Nigeria.

Government expenditure and agricultural production

According to, Udoka, Mbat & Duke [16], the sole provider of capital resources and financial incentives for the agricultural sector over the years has been the government Nwosu & Olaitan [29,30], pointed out that there had been consistent attempt to increase these support incentive by government through increased budgetary expenditure and provision of affordable credit facilities. However, Olowa & Olowa [31], revealed that over the years, government budgeting provision has served as a critical determinant of the output and performance of the Nigerian agricultural sector.

Food and Agricultural Organization (FAO) concluded in 2008 that allocation of capital to the Nigeria agricultural sector from 1970 to 1980 averaged at 4.74 percent [16]. This figure rose to 7.00 percent between 1980 and 2000, and further moved to 10.00 percent between 2001 and 2007. Inspite of this upward trend, it was still far below what has always been recommended by FAO that government should assign about 25 percent of its budgetary allocations to development of agricultural sector. Along this line of reasoning, several studies [16,21,30,31], had focused toward examining impact of public expenditure on agricultural output and made their different discoveries. For instance, Nafisat [22], examined impact of government expenditure on agricultural output using OLS estimation technique for the period 1977 – 2006. The result showed that agricultural output did not respond positively and significantly to government spending on agriculture. It also confirmed that government contribution to agriculture was not enough for its development. The study therefore recommended that unique role of agriculture should be recognised so that the sector could earn its rightful share of government expenditures in future.

Ojo, Edorodu & Ayo [32] used data from 1975 to 2010 while studying effect of government expenditure on agricultural output of Nigeria. Results of their estimated OLS model revealed that government expenditure had a positive and significant effect on agricultural output during the period considered.

Furthermore, Udoka [33], studied effect of government expenditure on agricultural sector using annual time series data that spanned from 1991 to 2010. Employing OLS model, the result found that a positive but insignificant association existed between agricultural financing and its output in Nigeria. Also see Uger [34].

Finally, Udoka, Mbat & Duke [16], investigated effect of commercial banks’ credit on agricultural production in Nigeria using OLS regression model transformed into a natural logarithmic form. They found a positive and significant relationship between commercial banks credit to agricultural sector and agricultural production in Nigeria. Results also found that a positive and significant relationship existed between agricultural credit guarantee scheme fund and agricultural production in Nigeria.

Methodology

This study relies heavily on the use of secondary data, hence the research design adopted for the study is ex-post facto. Ordinary least squares econometric techniques were used to carry out its tests and analysis. The choice of this technique was based not only on its computational simplicity, but it was also as a result of its optimal properties such as linearity, unbiasedness, minimum variance, zero mean value of the random terms [35]. The regression approach, in general, was adopted because the study set out to assess impact of independent variables on a dependent variable. The dependent variable was the agricultural sector output, while the independent variables include; agricultural government expenditure, commercial bank loans and advances to agriculture and index of agricultural production.

Nature and sources of data

The type of data used for the study was secondary and were time series data. The data was collected from Central Bank of Nigeria (CBN) Statistical Bulletin, CBN annual reports and statement of accounts (various), and CBN Economic and Financial review (various).

Model specification

This study has been anchored on the theoretical framework that an increase in credit to the agriculture sector by both government and financial institutions would provide investible funds needed for investment in agriculture in the country. This, in turn, would lead to an increase in the output of agriculture and by extension, the general economy. Based on this theoretical postulation, the present study specified agricultural production as a linear function of credit disbursed by commercial banks to agricultural sector, agricultural expenditure on agriculture and index of agricultural productivity. Agricultural output as the dependent variable was being proxied by agricultural gross domestic product (AGDP), used as the dependent variable to represent agricultural output [36].

Based on these determinants, the model adopted from Udoka, Mbat & Duke [16] and modified, formulated and specified functionally as;

AGOUT – f (BCREDTA, GEXPTA, IAP) ………………………………. Equ. 3.1

Where;

AGOUT = agricultural output as a contribution to gross domestic product of Nigeria.

BCREDTA = bank credit to agriculture mirrored by commercial bank loans and advances to the agricultural sector

GEXPTA = government expenditure to agriculture

IAP = Index of agricultural productivity

The above model equation (3.1) was then expressed in its estimated form as;

AGOUT = ao + a1BCREDTA + a2GEXPTA + a3IAP + μ…………………. Equ (3.2)

Where; μ = Random error term; ao = constant and a1, a2, and a3 = the parameters to be estimated.

The theoretical (apriori) expectations about the signs of the coefficients of the parameters are;

a1 > 0, a2 > 0, a3 > 0

In order to minimize errors and boost results of the study tests, the paper shall make use of natural logarithm (ln) in equation (3.2) above to transform to equation (3.3) as follows:

In AGOUT = ao + a1lnBCREDTA + a2lnGEXPTA + a3lnIAP + μ…………. Equ (3.3)

Equation 3.3 would be applied in conducting regression tests and analysis for the study

Data Presentation, Analysis and Discussion of Results

Presentation of data

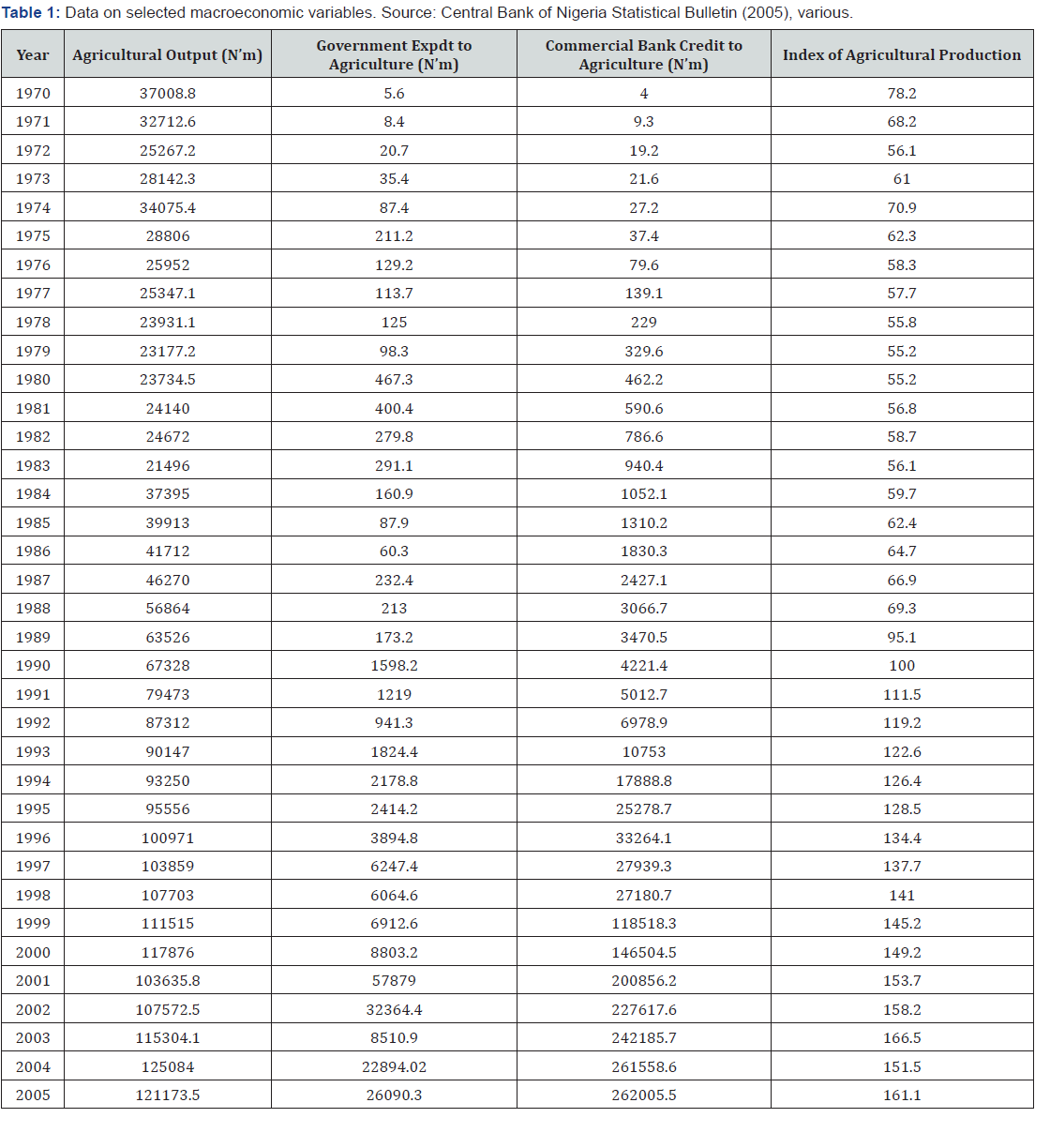

(Table 1) The data used for this study are presented in (Table 2) below. Data as presented in (Table 1) above showed that agricultural output was N37008.8 million in 1970 but decreased to N32712.6million in 1971, N25267.2 in 1972, respectively. It went up to N28, 142.3million in 1973 and to N34, 075.4million in 1974, respectively. In 1975, it began to decrease steadily from N28, 806million to N21, 496million in 1983. However, from 1984 agricultural output has been on the increase. It rose to N67, 328million in 1990 from N37, 395million in 1984 figure. Agricultural output further increased from N79, 473million in 1991 to N117,876million in 2000 and then decreased to N103,635.8million in 2001. In 2002, it began again to rise from N103, 635.8million steadily to N121, 173million in 2005 [37].

Within this period, government expenditure had a steady moderate growth rate from N5.6million in 1970 it grew up to N125million in 1978, then it dropped to N98.3million in 1979 and astronomically rose to N467.3million in 1980 and then went down to N400.4million in 1981 and yet dropped again to N278.9million in 1982, rose to N291.1m in 1983 and dropped to N160.9million in 1984, N887.9million in 1985 and to N60.3million in 1986, respectively; from which figure it rose to N232.4million in 1987, dropped to N173,2million in 1989, then rose to N1598.2million in 1990 then went down to N1219.million in 1991 and to N941.3million in 1992, respectively. Government agricultural expenditure went up to N1824.4million in 1993 and continued to rise steadily over the years to N57,879million in 2001, dropped to N32,364.4millioon in 2002, to N8,510million in 2003 and then revised to an increasing trend of NN22,894.02million in 2004 and to N26,090.3million in 2005. Hence, this analysis revealed that government agricultural funding had a fluctuating trend most of the times and that recorded increases were not enough to engender an optimization of agricultural output from the sector to the economy of Nigeria.

On the other hand, commercial bank credits to agriculture had experienced a steady and increasing growth rate from N7million in 1970 to a two-digit figure of N19.2milion in 1972, respectively. It rose to a three-digit figure of N139.1million in 1977 and from there it continued to rise till it reached an all-time high of N117,876million in the year 2000, it then went down to N332,64.1million in 1996. It dropped to N27, 939.3million in 1997 and to N27, 180.7million in 1995, respectively. It revised to an upward trend to N118, 518.3million in 1999 and continued to rise till it reached to a maximum figure of N262, 005.5million in 2005. This analysis revealed that although the banking system had a better steady supply of funds to agriculture, the quantum of its funds was not enough to make for a reasonable growth of agricultural productivity in Nigeria for the period covered by the study. Finally, the index of agricultural production (IAP) had a stable and better increasing trend in influencing agricultural productivity in Nigeria from the data analysis of this paper [38].

Results and Discussion

The estimated results of the regression analysis have been presented in (Table 2) below: From the results of (Table 2) above, it showed that all the explanatory variables except government agricultural expenditure (GEXPTA) had the right signs. A positive relationship was expected but the result showed a negative association between government and agricultural output. It meant that as more budgetary allocations were being directed to the sector, less has been felt in agricultural output growth. This negative showing could be attributed to embezzlement by public officeholders who often thwarted the good intentions of government in directing funds to priority sectors like agriculture. Government spent huge sums of money in procuring fertilizer to the farmers, but its distribution was usually based on political patronage with beneficiaries being members of the ruling party or expense of the actual farmers they were meant for.

Also, all the other three variables were significant at 1percent level in influencing agricultural output in Nigeria. However, index of agricultural production led agricultural output, and it was followed by commercial bank credit to agricultural sector (BCREDTA) as second and then the government agricultural expenditure (GEXPTA) came third in their descending order of magnitude in influencing agricultural productivity in the country. The adjusted R-squared and t-Statistic of the model indicated that agricultural output indicators jointly accounted for significant changes in agricultural productivity in Nigeria. Hence, since the Prob (F-statistic) is less than the (5%) test significant level, it has been concluded that the model is reliable and significant. Besides, the higher R- squared at 96 % depicted a higher the goodness of fit and as such the higher the explanatory power of the model. Similarly, since the value of Durbin –Watson (1.43) is getting closer to 2, it showed an indication of an absence of positive serial correlation in the model.

Summary of Findings, Conclusion and Recommendations

Summary of findings

This study focused on impact of government expenditure on agricultural sector of the economy. The role of agriculture in an economy cannot be over emphasized and so such funding of the sector from both governments and the private sector like, commercial banks, should be done appropriately [1]. A model which expressed agricultural government expenditure, commercial bank loans and advances to agriculture and index of agricultural production as determinants of agricultural output was estimated using an OLS regression analysis that applied time series data for the 35 years period covered by the study.

Hence, the main findings of this study are summarized thus below:

a) Bank credits to agriculture had a positive and significant impact on agricultural output. It means that funding of agriculture by banks would lead to an increased agricultural output.

b) Government expenditure to agriculture had a negative and significant impact of agricultural output against apriori expectations. That it assumed a negative posture could mean that Nigerian government has not been adequately funding the agricultural sector to achieve expected maximum productivity in agriculture to contribute more meaningful to growth of the national economy over the years. It could further be since as budgetary allocations were being directed to the sector, less was being felt in the agricultural development of the economy.

c) Index of agricultural production had a positive and very significant impact on agricultural output. This particular result could portend for a call to a re-enforced impact been consequent of ploughing-back into agricultural production harvests or yields of previous year’s output./

Conclusion

Agricultural credit is believed to be a very important ingredient in farming activities as adequate provision of funds to farmers would make all activities in the farm possible and lead to increase in output. Based on this premise, the study was targeted to ascertain impact of government agricultural spending and bank credit to agriculture on output of agricultural sector of Nigeria. From the findings of this research, there existed a positive and very significant association between bank credit and agricultural productivity in Nigeria. The result also established that index of agricultural production related positively and significantly with agricultural output of Nigeria. Further investigation revealed that government expenditure on agriculture had a significant but negative effect on agricultural output of the country.

Recommendations

The following recommendations from the findings of this research have been stated below for policy action.

a) The positive effect of commercial banks’ credit to agriculture on agricultural output calls for more allocation of credits to the agricultural sector by the banking sector generally. This could be achieved by the Central Bank of Nigeria (CBN) lowering the interest rate charged on farmers for money borrowed for the purpose of agricultural productivity or agricultural loans generally. This agrees with Udoka, Mbat & Duke [16] study in enhancing accessibility of agricultural loans to farmers.

b) The negative but insignificant impact of agricultural expenditure on agricultural output against apriori expectations showed that Nigerian governments (Federal, State and Local) have been underfunding the agricultural sector over the years. This discovery calls for more government spending in the sector as such spending would provide the needed funds for the farmers for increased agricultural productivity. It is therefore recommended that government should make huge investments into agricultural productivity by providing infrastructures, tractors, good roads, fertilizer, electricity, fund agriculture research institutes, etc to rise growth in agricultural output of Nigeria.

Finally, the positive effect of index of agricultural production on agricultural production calls for a plough – back or re-investment of yields from past farm produce rather than consume all. It showed that reinvesting a lagged agricultural output would lead to an increase in future yields. It is therefore so recommended for maximum agricultural productivity in Nigeria in the years ahead.

https://juniperpublishers.com/asm/ASM.MS.ID.555620.php

Comments

Post a Comment